As published in The Canmaker July 2021 article, by Sayers Publishing Group, featuring insights from David Williams and Joe Bohlen.

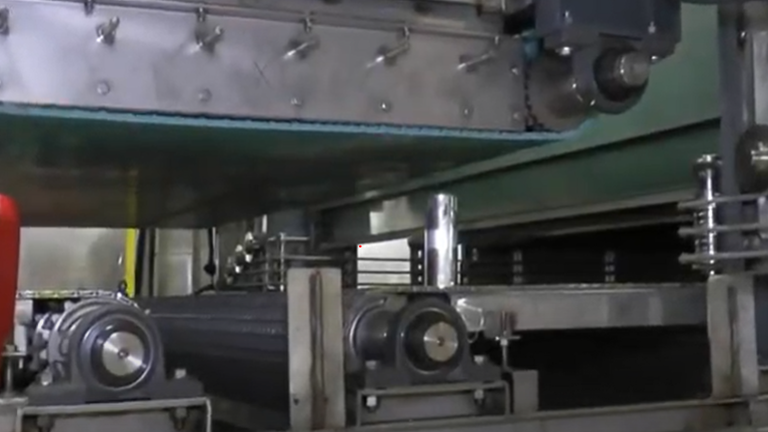

“Can washer manufacturer Cincinnati Industrial (CIM) is also mindful of the impact of downtime on hard-pushed canmakers.

The Ohio-based behemoth in the washer sector has begun marketing an Automatic Quick Adjustment product that enables the speedy switch for its can washers to accommodate different container sizes. A year in development, the product will accurately adjust washing equipment to manage all trim heights.

The first-of-its-kind push-button mechanism requires no manual input and cuts the changeover downtime from an hour-and-a-half to “the time it takes for the engineer to get a coffee”, says CIM president David Williams.

The mechanism can be built into new washers or retro-fitted to older machines.

It was designed to meet canmaker and brand demands for a wider range of packaging formats as beverage markets fragment. Consumers of alternative alcoholic beverages (AABs) such as seltzers, low-and-no alcohol beers and ready-to-drink (RTD) cocktails, prefer their products packaged in slimmer cans, according to data from researcher IRI. In response, canmakers have increased production of slim, sleek and smaller cans.

The increased number of product types has also meant production runs have become smaller, meaning canmakers must fit more factory lines to

accommodate them or change lines over more often.

“We’re finding that a lot of canmakers are running different cans – slim cans, standard cans and so on – and they do smaller batches and every batch size needs a new trim height so there’s a big changeover needed at the plant,” explains CIM vice-president for technology and

veteran can washing expert Joe Bohlen.

“Our product means the machine takes care of itself on height adjustments. It automatically turns the cranks and resolvers, gets the accuracy set and it cranks away for just a few minutes.”

Williams adds that in many cases the time saved is greater. “One-and-a-half hours for a manual changeover is a best case scenario – if you’re doing it manually and you are off somewhere then you have to thoroughly check and that creates some downtime and product rejects,” Williams says.

More capacity Canmakers are building new plants and lines, and analysts estimate that this investment will this year see capacity of about five billion cans added to annual output in North America. And more are on the way.

Even so, analysts and canmakers, including Ball, expect supply to lag behind demand for another few years meaning that capacity already online will

need to run at the highest efficiencies, and that means the least downtime.

“Shutting a line down is painful – you want to do it as little as possible,” says Bohlen.

CIM believes its new product will also help canmakers adjust to the impact of rising inflation. US consumer prices rose by five per cent in May, the most since 2008. While that’s attributable to the US economy’s rapid recovery from the Covid pandemic downturn, it’s also partly the result of surging global commodity prices amid shortages of raw materials, including aluminum.

Brand owners have two main responses – pass on the increased costs of materials to consumers or reduce packaging sizes to maintain product prices. Williams argues that the ability to quickly switch production to smaller can sizes will play a part in canmakers’ strategies.

“This will become more and more valuable as we see inflation rise,” he says. “Companies are reducing package sizes to adjust for inflation.”